- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

- Cashback FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

What are Hybrids?

From our InvestSMART Hybrid Income Portfolio Page:

Designed for investors an opportunity to diversify their income stream with a portfolio of predominantly ASX-listed hybrid securities.

Hybrid securities combine elements of debt (like bonds) with aspects of shares. Our Hybrid Income Portfolio gives investors the potential to earn a higher return than fixed-interest securities though still with a regular income.

Hybrids are preference shares that pay a floating rate of return each quarter which is usually franked. This is a good source of regular income for retirees, similar to, though riskier than, a term deposit.

What asset class do they fall into, and approximately what percentage of that asset class should I apportion to hybrids?

Hybrids are typically held as defensive assets, though there is some equity risk.

Therefore, these are typically included as part of your bond or fixed interest allocation and should be less than 50% of that allocation.

Rising interest rates are not usually good news for bond and fixed-interest portfolios, as capital values tend to fall. However, as hybrids have distributions based on a fixed margin above the cash rate, as the cash rate increases then, the distributions increase.

The portfolio currently only has floating rate hybrids which the major banks have issued.

When a hybrid reaches its first “call” date, the issuing bank has the choice to pay the investor in shares or cash equivalent to the issue price of the hybrid (usually $100).

To date, all the major bank hybrid issuers have redeemed their hybrids for cash. If an issuer decided to issue shares, you would receive enough shares to give you the same cash value as the issue price.

All the hybrids in the InvestSMART portfolio pay franking credits on each distribution.

How do I claim my franking credits?

When you lodge your tax return, you will receive a credit for the tax already paid on the hybrid distribution. Depending on your tax situation, you may get a tax refund.

A bond is issued as a note by a corporate or government and is redeemed on a fixed date in the future. Bonds usually pay a fixed rate of interest semi-annually.

Hybrids are preference shares and rank below bonds in the event of a liquidation of the issuer, pay dividends that can be franked and usually have no maturity date. Investors are relying on the issuer to “call” (redeem) the issue to be repaid or will have to sell on the ASX to get their investment back.

Yes. You will receive a comprehensive tax statement at the end of financial year and you will receive the franking you're entitled to once you submit your tax return.

Choosing the right portfolio depends on your investment goals, time frame, and risk tolerance. To help you decide, consider the following:

1. Investment Time Frame: Each portfolio has a suggested time frame. Ensure it aligns with your financial goals:

2. Target Market Determination (TMD): Review the PMA Target Market Determination to understand the intended investor profile for each portfolio.

3. Tools & eBook Guides: InvestSMART provides several resources to help you choose the right portfolio.

Here is a list of tools and guides to help select the right portfolio:

- InvestSMART's Statement of Advice – A tailored Investment Plan with step-by-step guidance.

- Guide to Growing Wealth – Strategies to build your portfolio.

- Guide to Investing in Retirement – Insights for managing your investments during retirement.

- Investor Pack – A comprehensive overview of InvestSMART’s offerings.

Calculators:

- Wealth Savings Calculator

- Property Savings Calculator

- Education Savings Calculator

- Retirement Savings Calculator

For a deeper dive into investing, explore InvestSMART Bootcamp, a complete investment course designed to help you get started.

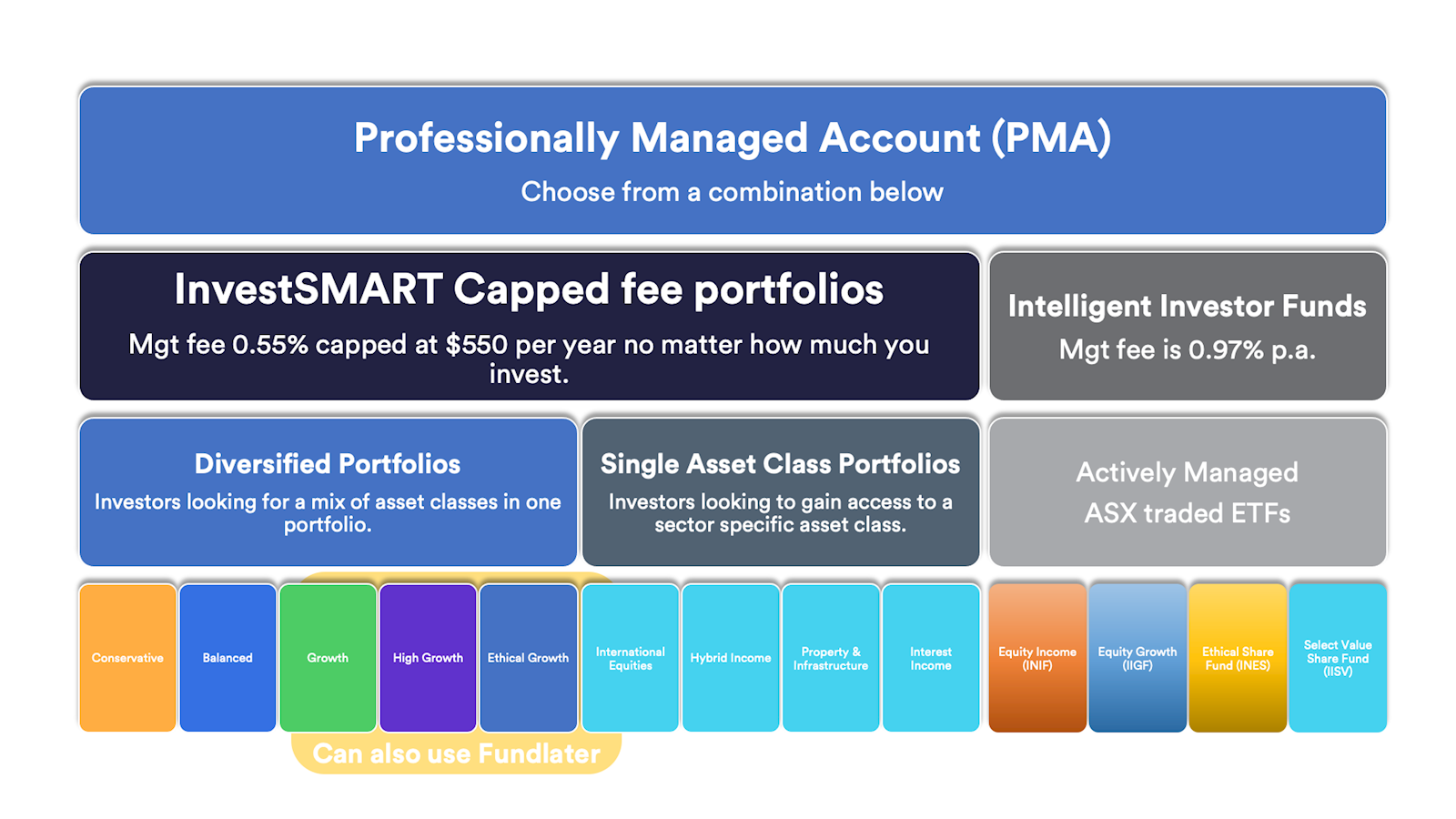

The InvestSMART Professionally Managed Account (PMA) is established and offered within the registered managed investment scheme known as the Professionally Managed Accounts.

Each investor has a separate account to which their investments are allocated. You will require a different PMA for each investment entity you have e.g. individual, joint, SMSF etc.

A client will open an InvestSMART PMA and can then choose between the various InvestSMART Diversified Portfolios. An account can hold one or more models but can only hold one diversified portfolio. The management fee is charged at the account level, not per portfolio.

Once you decide which model portfolio(s) are best suited to your investment needs and objectives, we will purchase the investment to be included in your account to reflect the model portfolio or combination of model portfolios that you have selected.

When you open an InvestSMART Professionally Managed Account (PMA), you choose from InvestSMART's range of Diversified Portfolios to invest in.

A list of the portfolios can be found here.

These managed portfolios comprise of Exchange Traded Funds (ETFs) or, in some cases direct shares. In particular, the InvestSMART Hybrid Income Portfolio invests in Australian listed hybrids and listed debt securities.

What is an Exchange Traded Fund?

An Exchange Traded Fund, or ETF, is a managed fund that trades on the stock market.

There are different types of ETFs, each with its own purpose, but most commonly, they will track or follow a particular index.

For example, if you want to follow or track the S&P ASX 200 (the top 200 Australian shares by market capitalisation), you could either buy each individual share (200 shares) or one ETF. The one ETF wraps up the 200 shares into one holding. By holding this one ETF, you get exposure to the movements of the ASX 200, less any fees.

Investing in ETFs is a form of passive investing, and they generally incur cheaper management fees, as fewer investment decisions are required to manage an ETF. They are also quite liquid and traded easily on an exchange.

You can see the holdings of each InvestSMART managed portfolio by navigating to its product page and scrolling to Key Facts > Holdings.

Yes, all investments held within your InvestSMART PMA are held in your name (or chosen entity e.g. SMSF) in a CHESS sponsored broking account.

You are the registered legal and beneficial owner of a portfolio of securities. You can log into the investor website at any time to view the individual securities that make up your Account.

.png)