- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

- Cashback FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

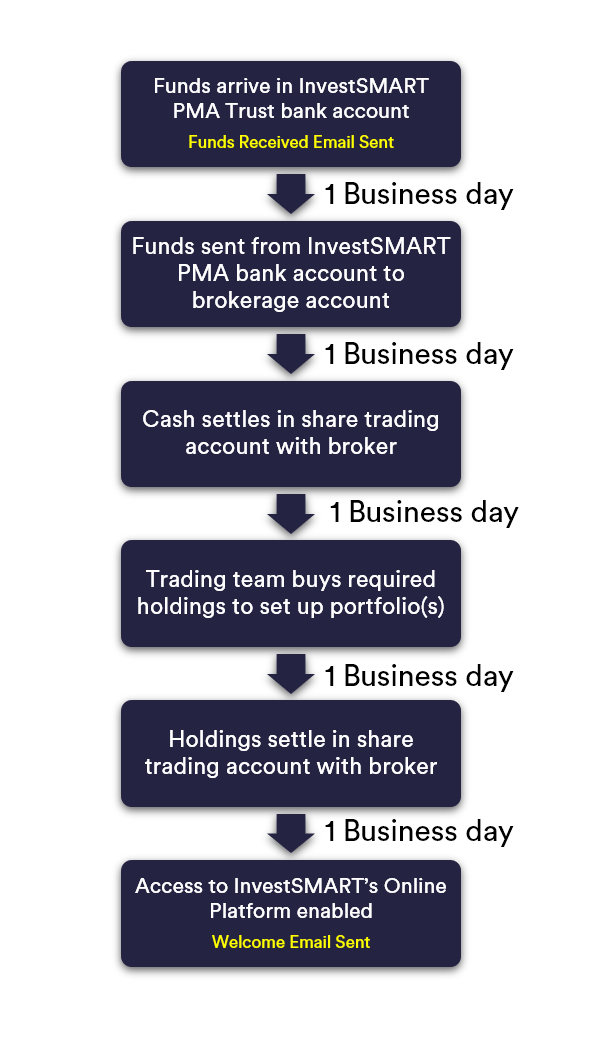

The Process

When you BPAY your funds before 6 pm on a business day, they will typically arrive in our PMA Trust Account the following business day.

We will email you that we have received your partial or total funds, depending on the amount you have sent.

Once we have received the total funds for investment, we will then send your funds to the share brokerage account opened in your name. This transfer typically takes overnight as well.

When your funds arrive at the share broker the next business day, we will begin to purchase holdings in line with your chosen portfolio.

Once the shares/ETFs have settled (T+2), we will enable the online platform for you to view and administer your holdings. We will send you a welcome email explaining how to access the online platform.

This process takes about 4-5 business days from when we receive your total funds.

Why does it take 4-5 business days and not immediately?

We're proud to offer low and capped management fees for our InvestSMART investment products. At the heart of everything we do, our purpose is to make investing rewarding, accessible and affordable.

To keep fees low and capped, we take a process-driven approach. For instance, our trading team can keep costs down by trading once a day during a specific period. This means that funds received are actioned the following business day.

Settlement periods

As with any ASX listed share or ETF, there is a two business days settlement period. The ASX explains this here. This settlement period means your holdings won't settle until two days after the transaction takes place.

Your investments are held in a CHESS sponsored brokerage account. This adds an extra layer of protection and can offer more tax advantages as you can transfer holdings to your share trading account and not be forced to sell them. However, this means that getting funds from your bank account to the brokerage bank account adds an extra step. We are in the process of investigating CMA accounts to improve this.

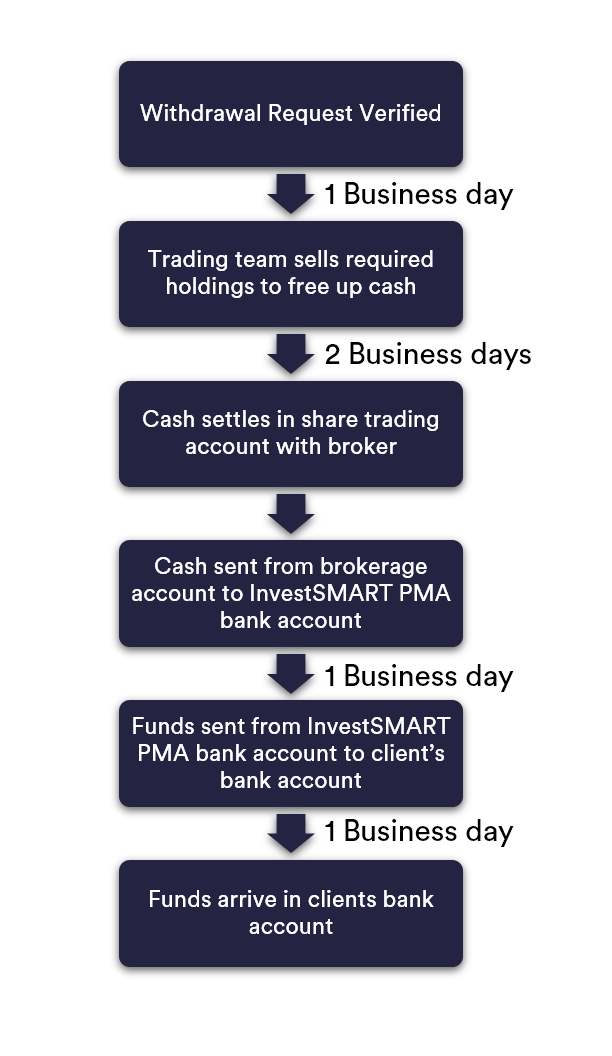

Withdrawals typically take 4-5 business days from the day you verified the withdrawal request.

Because of the delay with data reflected in the My Account section, you may see your cash component in your PMA larger than usual.

This increased cash holding is temporary and shows that the cash has been 'freed up' and will shortly be sent to your nominated bank account.

Why does it take 4-5 business days and not immediately?

We're proud to offer low and capped management fees for our InvestSMART investment products. At the heart of everything we do, our purpose is to make investing rewarding, accessible and affordable.

To keep fees low and capped, we take a process-driven approach. For instance, our trading team can keep costs down by trading once a day during a specific period. This means that withdrawal requests that are verified and submitted are actioned the following business day.

Settlement periods

As with any ASX listed share or ETF, there is a two business days settlement period. The ASX explains this here. This settlement period means your funds won't be available until two days after the transaction takes place.

Your investments are held in a CHESS sponsored brokerage account. This adds an extra layer of protection and can offer more tax advantages as you can transfer holdings to your share trading account and not be forced to sell them. However, this means that getting funds from your brokerage bank account to the InvestSMART bank account adds an extra step. We are in the process of investigating CMA accounts to improve this.

What can I do to help?

Please be aware of the four to five day withdrawal period and factor in potential public holidays that may extend the process.

Ethical investing, also known as socially responsible investing or sustainable investing, is an investment strategy that integrates environmental, social, and governance (ESG) criteria into the decision-making process. This approach allows investors to align their financial goals with their values, promoting responsible corporate behaviour and creating a positive impact on society and the environment.

What is ethical investing?

Ethical investing involves considering a company's financial performance and its impact on society and the environment when making investment decisions. It aims to generate returns while supporting businesses that demonstrate ethical and sustainable practices. Ethical investing can be applied to various asset classes, including stocks, bonds, and ETFs.

Ethical investing as an investment strategy

Ethical investing offers several benefits:

- Aligns investments with personal values: Ethical investing allows individuals to support companies and industries that align with their values and avoid those that do not.

- Mitigates risks: Ethical investments tend to focus on companies with strong ESG performance, which often translates into lower risks and better long-term financial performance.

- Drives positive change: By investing in companies with responsible practices, investors can influence corporate behaviour and promote sustainability.

- Diversification: Ethical investing can provide exposure to new and emerging industries that focus on sustainable solutions, potentially enhancing portfolio diversification.

Understanding the ESG criteria

ESG criteria are a set of standards used to assess a company's ethical and sustainable practices.

You can search the Refinitiv ESG website to see ESG scores for various companies. ESG Scores | Refinitiv

They include:

- Environmental: This focuses on a company's impact on the environment, including pollution, waste management, resource conservation, and climate change mitigation.

- Social: This considers a company's relationships with its employees, suppliers, customers, and communities, evaluating aspects like human rights, labour practices, and diversity.

- Governance: This examines a company's leadership, transparency, and internal controls, encompassing areas such as corporate governance, executive compensation, and shareholder rights.

How to go about ethical investing

There are several ways to incorporate ethical investing into your investment strategy:

- Research: Investigate individual companies and industries to evaluate their ESG performance. Look for companies with strong ESG ratings, certifications, or awards.

- Use ESG-focused funds: Choose mutual funds or exchange-traded funds (ETFs) that specifically focus on companies with strong ESG performance. These funds often have "ESG" or "sustainable" in their names.

- Work with a financial advisor: Seek advice from a financial professional who specializes in ethical investing. They can help you create a personalized investment strategy that aligns with your values and financial goals.

- Shareholder activism: Actively engage with the companies in your portfolio by attending shareholder meetings, voting on proxy proposals, or even submitting your own proposals to promote positive change.

How can InvestSMART Group help?

InvestSMART offers an Ethical Growth Portfolio through its Professionally Managed Account (PMA).

The Ethical Growth Portfolio is invested in a blend of 5 – 15 ethical Exchange Traded Funds (ETFs). Each ETF invests in a different asset class like Australian equities, international equities and fixed income like bonds.

The Intelligent Investor offers an ASX-traded fund called the Intelligent Investor Ethical Share Fund. It has the ticker code ASX: INES.

The Intelligent Investor Ethical Share Fund (ASX:INES) invests in quality businesses managed by insider owners or CEOs who think long-term while considering environmental, social, governance and ethical considerations. It is an actively managed portfolio of 10-35 stocks in one ETF.

In conclusion, ethical investing provides a meaningful way for investors to align their financial goals with their values. By incorporating ESG criteria into their investment decisions, individuals can support responsible companies, drive positive change, and potentially enjoy better long-term financial performance.

For more educational resources about Ethical Investing, you might want to visit:

The Responsible Investment Associate Australasia

Home - Responsible Investment Association Australasia (RIAA)

RIAA champions responsible investing and a sustainable financial system in Australia and New Zealand. It has over 500 members and provides tools for investors.

ETF Filter and Compare Tool at InvestSMART

You can enter Ethical as the search Keyword.

ETFs | Exchange Traded Funds, ETF Investing & Performance (investsmart.com.au)

For InvestSMART's capped-fee diversified portfolios, we endeavour to create portfolios that accurately reflect the risk profiles that investors seek by diversifying across various asset classes. These portfolios range from Conservative, Balanced, Growth, Ethical Growth, to High Growth, with each portfolio designed to achieve the optimal balance between risk and return for its clients. It might seem counterintuitive for InvestSMART to allocate a significant portion of the portfolio to Australian equities; however, there are several justifications for this decision:

Home bias

Home bias is a tendency for investors to prefer investing in domestic assets, as they may have better familiarity and understanding of the local market. This home bias is not unique to Australian investors; it is a phenomenon observed across many countries. By having a significant allocation to Australian equities, InvestSMART caters to its client base's preferences.

Tax benefits

Australian investors may benefit from favourable tax treatments for investing in domestic equities. The dividend imputation system, for example, allows Australian shareholders to receive tax credits on dividends, effectively reducing the tax burden on these investments. These tax benefits can make Australian equities more attractive compared to international equities, leading to a more significant allocation in the portfolio.

Currency risk

By investing in domestic assets, investors can mitigate the currency risk associated with international investments. Fluctuations in exchange rates can impact the returns on international assets. By having a significant portion of the portfolio in Australian equities, InvestSMART helps its clients manage this risk.

Diversification within Australian equities

The Australian stock market encompasses many companies operating across diverse sectors, including finance, resources, and healthcare. Investing in a broad array of Australian equities, such as the entire ASX200 Index through an ETF like ASX: IOZ, InvestSMART can attain a considerable degree of diversification within this asset class. Consequently, this approach helps safeguard the portfolio against sector-specific risks.

A broad range of investment portfolios

InvestSMART acknowledges that clients have varying investment goals, timeframes, and risk profiles. To accommodate these diverse requirements, the firm provides an array of investment portfolios and strategies for clients to choose from based on their own understanding of their preferences and needs. InvestSMART does not offer personalised financial advice but empowers clients with a selection of investment options, allowing them to make informed decisions on which portfolio best aligns with their circumstances. This approach ensures that InvestSMART caters to a wide variety of client requirements without providing tailored financial advice.

In summary

While it might seem unusual for InvestSMART to have a significant allocation to Australian equities within their diversified investment portfolios, there are valid reasons for this decision. These include home bias, tax benefits, currency risk management, diversification within the asset class, and an extensive range of investment portfolios. However, it is essential for investors to understand their own risk tolerance and investment objectives and to carefully consider their options when selecting a portfolio to ensure appropriate diversification.

The InvestSMART Capped Fee Diversified Portfolio range invests in Exchange Traded Funds (ETFs) across a range of different asset classes including Australian shares, international shares, cash, fixed interest, property and infrastructure.

ETFs are great for managing risk, keeping costs low and providing a diversified portfolio.

Our range of diversified portfolios focus on investing over several asset classes in different proportions to provide different risk vs. return profiles tailored to suit the requirements of all investors.

The core investment philosophy at InvestSMART focuses on the principles of diversification, low fees and investing for the long term. Exchange Traded Funds (ETFs), in comparison to unlisted managed funds, provide a cost-effective method to ascertain these goals. They also have liquidity benefits, being easier to buy and sell at short notice.

ETFs provide broad diversification by only needing to purchase a small number of securities. In contrast, when buying and holding hundreds of individual securities to achieve a similar level of diversification, greater costs are incurred in brokerage and fees – imagine the brokerage to buy 200 individual stocks!

ETFs are also great for managing risk. When you invest in an ETF, you lessen individual company risk and sector risk. By holding a basket of individual stocks, you are not limiting your exposure to individual sectors of the market.

In using ETFs, InvestSMART has the capacity to pass on these lower costs to the investor in the form of capped fees and low-cost investing. As fees compound over time, even a slight increase in fees can result in substantial differences to your return.

You can read more on ETFs here.

We invest across a broad range of asset classes, as no one individual asset class is guaranteed to deliver substantial and consistent performance – once again it comes back to one of InvestSMART’s core principles of diversification.

|

Cash |

Provides protection against the volatility of markets in times of market downturns. Why is there cash listed in my portfolio? |

|

Bonds |

As a defensive asset, bonds provide a consistent income. They are less volatile in comparison to equities. |

|

Domestic Equities |

Delivers strong returns over the long term, even when considering exposure to global and domestic downturn. Share value often fluctuates in the short term. |

|

International equities |

Australian shares make up a mere 2% of the globes total market capitalisation. International equities provide access to potential returns in sectors that are underweighted in the Australian equity market (such as technology) and additional diversification benefits. |

|

Property & Infrastructure |

Provides growth in line with inflation, or real income growth and is less volatile in comparison to equities. |

Full holdings for each portfolio can be found here, under Investment Preferences:

- On the portfolio you are interested in, select 'learn more'

- Scroll down to 'key facts'

- Select the subheading called 'holdings'

From here, you will be able to see asset allocation by percentage, and also a comprehensive list of the holdings.