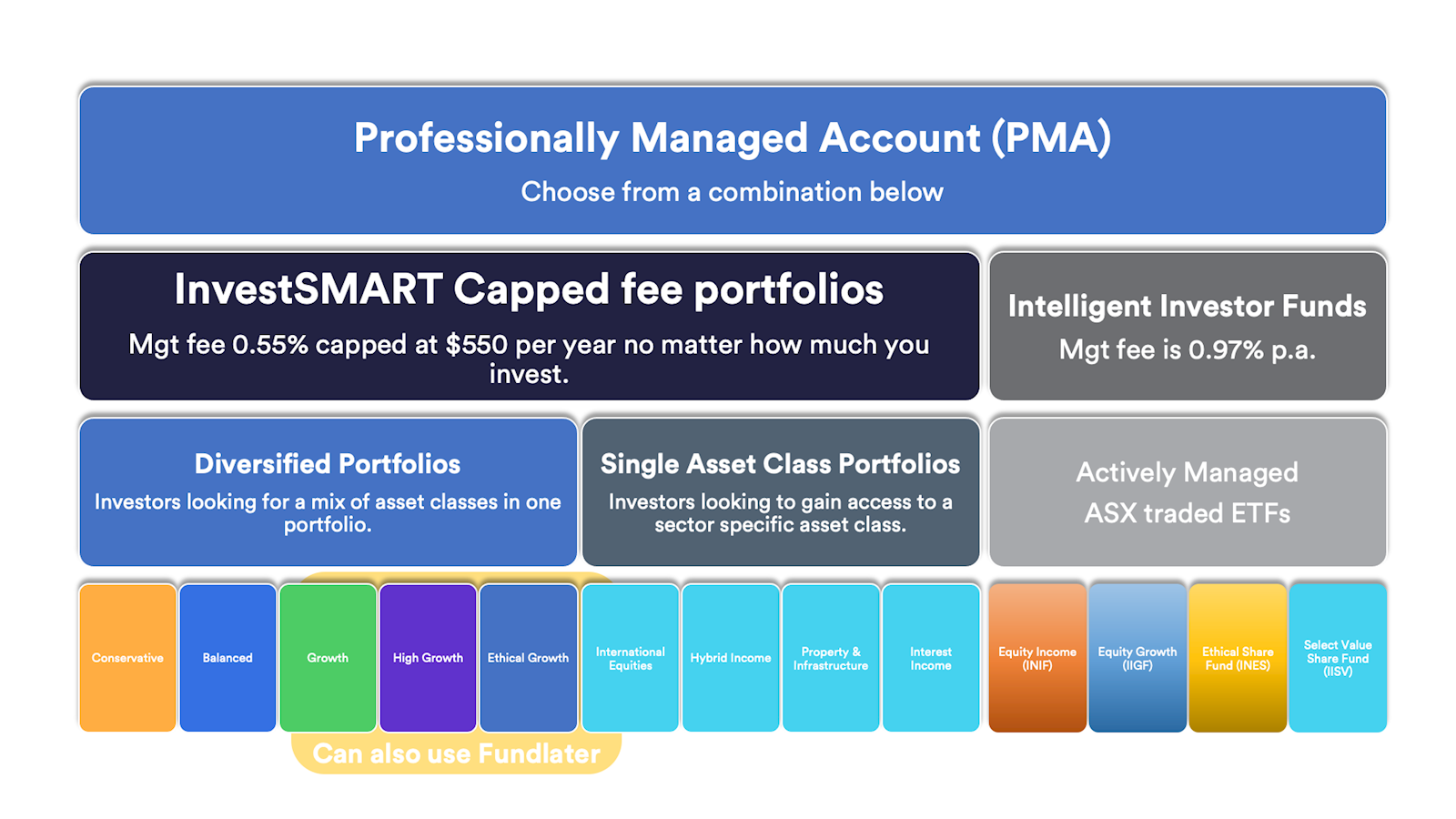

What are the benefits or disadvantages holding II ETFs inside the PMA?

You can choose to hold an Intelligent Investor fund directly through your share broker or inside an InvestSMART PMA.

|

|

Inside PMA |

Held through share broker |

|

Time needed to buy |

4-5 business days to reflect in your PMA |

Shows immediately when purchased |

|

Time needed to sell |

You can process a withdrawal. Takes 1-2 business days to sell on market. |

Can sell immediately at market price |

|

Fees |

0.97% p.a. plus 0.11% admin fee - you are not charged InvestSMART's capped fees on these holdings. |

0.97% p.a. |

|

Dividends |

Dividends are paid into the cash component of the PMA. You can have income paid out monthly. The default is to have the dividends reinvested into the whole of the PMA. This means that your II ETF dividends may be invested into one of the InvestSMART portfolios if you hold them. |

You can use dividend reinvestment or have them paid out. |

|

Tax Statements |

You generally have to wait until the PMA tax statements are ready. |

You received these from the share registry as soon as they’re ready. |

|

Adding to the II ETFs |

You can add funds to the PMA and have them go to the II ETF but it may not be allocated depending on the amount. See ‘Cash allocation’. |

You can add amounts as low as $500 through your share broker. |

.png)