- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

- Cashback FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

Our Investment Philosophy

The InvestSMART Capped Fee Diversified Portfolio range invests in Exchange Traded Funds (ETFs) across a range of different asset classes including Australian shares, international shares, cash, fixed interest, property and infrastructure.

ETFs are great for managing risk, keeping costs low and providing a diversified portfolio.

Our range of diversified portfolios focus on investing over several asset classes in different proportions to provide different risk vs. return profiles tailored to suit the requirements of all investors.

The core investment philosophy at InvestSMART focuses on the principles of diversification, low fees and investing for the long term. Exchange Traded Funds (ETFs), in comparison to unlisted managed funds, provide a cost-effective method to ascertain these goals. They also have liquidity benefits, being easier to buy and sell at short notice.

ETFs provide broad diversification by only needing to purchase a small number of securities. In contrast, when buying and holding hundreds of individual securities to achieve a similar level of diversification, greater costs are incurred in brokerage and fees – imagine the brokerage to buy 200 individual stocks!

ETFs are also great for managing risk. When you invest in an ETF, you lessen individual company risk and sector risk. By holding a basket of individual stocks, you are not limiting your exposure to individual sectors of the market.

In using ETFs, InvestSMART has the capacity to pass on these lower costs to the investor in the form of capped fees and low-cost investing. As fees compound over time, even a slight increase in fees can result in substantial differences to your return.

You can read more on ETFs here.

We invest across a broad range of asset classes, as no one individual asset class is guaranteed to deliver substantial and consistent performance – once again it comes back to one of InvestSMART’s core principles of diversification.

|

Cash |

Provides protection against the volatility of markets in times of market downturns. Why is there cash listed in my portfolio? |

|

Bonds |

As a defensive asset, bonds provide a consistent income. They are less volatile in comparison to equities. |

|

Domestic Equities |

Delivers strong returns over the long term, even when considering exposure to global and domestic downturn. Share value often fluctuates in the short term. |

|

International equities |

Australian shares make up a mere 2% of the globes total market capitalisation. International equities provide access to potential returns in sectors that are underweighted in the Australian equity market (such as technology) and additional diversification benefits. |

|

Property & Infrastructure |

Provides growth in line with inflation, or real income growth and is less volatile in comparison to equities. |

Full holdings for each portfolio can be found here, under Investment Preferences:

- On the portfolio you are interested in, select 'learn more'

- Scroll down to 'key facts'

- Select the subheading called 'holdings'

From here, you will be able to see asset allocation by percentage, and also a comprehensive list of the holdings.

How InvestSMART manages risk

Unfortunately, there is no way to completely avoid risk. As such, we opt to manage risk instead. The best way to mitigate risk and achieve better long-term risk-adjusted returns is through the process of diversification.

We manage the portfolio's risk by maintaining and rebalancing the portfolios in line with the associated risk profile mandate. The risk profile mandate also corresponds with the recommended time frame.

Over time, with an adequately diversified portfolio, it is still possible to achieve an acceptable return. This is based on research by Nobel Prize-winning economist, Howard Markowitz, on the Modern Portfolio Theory. His theory demonstrates how you can combine numerous assets with different volatilities to minimise overall portfolio volatility.

When one portion of your portfolio is performing poorly, another is expected to be performing above average and balance out the negative effects of the asset lacking in performance.

How investors can manage risk

Investors can manage risk by investing in a portfolio that is suitable to meet their goals and timeframe. Each of our portfolios has a mandate that explains the risk profile and suggested timeframe, which can be found here.

Diversification in line with adhering to the investment timeframe significantly reduces the risk on your portfolio.

InvestSMART offers a range of model portfolios that investors can choose from, which may fit their self-determined risk profile. There are a number of tools that can be used to get a better understanding of your risk profile.

Whilst we do not manage risk on a client-by-client basis, we do manage risk when selecting securities for these models.

Diversification is all about managing risk. To put it simply, diversification means spreading your investment risk across a variety of assets and asset classes. This way, if one asset or asset class performs poorly, your other investments help to offset this poor performance, protecting your capital. The more uncorrelated assets and asset classes you invest in, the less risk you face of an underperforming asset damaging your overall return. This is where the use of ETFs comes into play - they provide a means to diversify across asset classes; and also are well-diversified within asset classes.

Diversification can seem complicated to some investors – but this doesn’t have to be the case. There are currently lots of options available for investors who want to diversify but need a little bit of help in doing so. At InvestSMART we offer a range of already diversified portfolios that you can use to complement and diversify your existing investments or use as a total portfolio solution.

Building a diversified investment can sound intimidating. However, the process isn’t as complex as it seems. To help you out, InvestSMART has developed a variety of tools and resources. Our Portfolio Manager allows you to track your assets and monitor your net wealth. You can also use the InvestSMART HealthCheck tool to help understand how well diversified your portfolio is, and whether your asset allocation is appropriate in achieving your desired financial objectives.

Investing is a longer-term strategy to reach financial goals and investment timeframes are correlated directly with your risk profile. Your risk profile alludes to how much volatility you can handle as an investor.

Those with more conservative risk profiles seek less volatility and as such, someone with a higher risk tolerance is more willing and able to take on greater levels of volatility (or risk). It is important to bear in mind that your personal risk profile does not always correlate with your investment risk profile, but rather should correlate with your investment timeframe.

For example, if you are saving to purchase an asset in the short term (within a year or two), such as nearing the end of a savings goal for a house deposit, you would have less time to experience volatility such as a drop in the market. Then, your investment timeframe is shortened, and you may accept a lower risk profile.

The inverse holds true for those with a longer investment time frame, such as in the case of a long-term savings goal of purchasing a property, saving for retirement or other goals beyond the timespan of 5+ years. A plethora of factors, including social, economic and political factors, all could impact the way the market moves; it is unpredictable in nature, and often even top fund managers aren’t able to predict the market. As such, we go back to the age-old saying time in the market > timing the market.

Research has consistently shown why timing the market doesn’t work (in the words of InvestSMART CEO, Ron Hodge) and concludes that those who are invested over the long-term in a well-diversified portfolio will generally perform better than those who attempt to predict when and where the market is going to move.

However, timeframes are just a suggestion and it is ultimately your decision if you would like to withdraw funds before the time has elapsed.

In this article, we'll explain how we handle portfolio rebalancing within our Investment PMA, including the importance of daily reviews and the various factors that may prompt a rebalance. We'll also touch upon our efforts to minimise transaction fees and the passive nature of our investment strategy.

Daily Review

We examine our model portfolios on a daily basis for several reasons:

- Deposit of funds: Ensuring that when investors deposit funds, their allocations align with the model portfolios.

- Withdrawal of funds: Adjusting the portfolio when investors withdraw funds to maintain the target allocation percentages.

- Dividends and distributions: Reinvesting any dividends or distributions received to keep the portfolio aligned with the model.

- Market moves: Monitoring market fluctuations that could cause holdings to drift from their target allocation percentages.

By conducting daily reviews, we can quickly respond to any changes and maintain the desired portfolio balance while keeping transaction fees in check.

Quarterly Investment Committee Meetings

Our our investment committee meets every quarter to review the portfolios and their benchmarks. If the benchmark has shifted significantly, the committee decides whether it's a short-term change or requires a long-term adjustment to allocations. As our mandate is to follow the benchmark, we generally adjust our portfolios accordingly.

Rebalancing

If necessary, we may rebalance the portfolios by selling or buying holdings to align them with the benchmark. This typically occurs once a quarter after the investment committee meeting. However, we are mindful of transaction fees, such as brokerage, and try not to rebalance too often to keep costs low for our investors.

Ad-hoc Rebalancing

In rare instances, we may introduce or remove a holding from a model, prompting an ad-hoc rebalance. Historically, this has happened no more than once or twice a year.

Adding/Removing Funds

Portfolios are also rebalanced whenever funds are added or removed.

New Holdings

We may introduce new holdings, such as a more suitable ETF, to maintain low costs for investors and enhance portfolio management.

Passive Investment Approach

It's important to note that our Investment PMAs are not actively managed. We don't try to predict or anticipate market moves. Instead, we follow a passive investment strategy, which means our portfolios track the market and accept the market return less any fees.

We hope this article clarifies our approach to portfolio rebalancing within the Investment PMA. By conducting daily reviews and making necessary adjustments, we aim to maintain an optimal balance in your investment portfolio while adhering to a passive investment strategy. If you have any further questions, please don't hesitate to reach out.

We understand it will happen, but it’s unpleasant when it does. So, here’s what to do when your account balance goes the wrong way.

Volatility

The securities markets are often associated with big swings in prices. For example, when the stock market rises and falls more than one per cent over a sustained period, it is called a “volatile” market. See Nuts and Bolts: What is Volatility.

Reasons behind volatility will vary, and seeing headlines detailing consecutive down days in markets and then seeing the flow-on effect on your investment portfolio tends to induce concern.

We invest knowing down days will occur, and it’s how we react to them that will determine your long-term investment success. Here’s how you and InvestSMART help to manage volatile times and keep your investments on track:

- Diversification is the key to lowering volatility over time. InvestSMART rebalances your portfolio from time to time, ensuring your portfolio maintains a blend of assets in line with the mandate of each portfolio. In short, we make sure a balanced portfolio remains balanced. It gives you confidence your portfolio blend and risk is in line with your expectations.

- Make sure your investment portfolio is in line with your investment time horizon. The length of the timeframe directly correlates to the breakdown of growth and defensive assets each portfolio invests in. The longer the timeframe, the higher the growth assets and the greater the volatility. That timeframe allows for market downturns and provides time to recover. InvestSMART makes this easy for investors by clearly indicating the recommended timeframe for each portfolio.

- What you can do to help. Focus on your timeframe. You know downturns happen. It’s par for the course when it comes to investing. Stick to your timeframe, continue your regular contributions and add more funds if you can.

I’d recommend this excellent piece by my colleague John Addis on How to Worry Better for further reading.

Finally, we’re here to help. Use the chat function, email or call on 1300 880 160. We cannot provide personal/specific advice, but we can talk about investing generally and account management.

At InvestSMART, we’re all about making investing simple. We believe that everyone should have the confidence to control their financial future and it shouldn’t be hard or expensive to do so. Our mission is to help all Australian’s grow and protect their wealth. Whether you’re managing your own investments or looking for a little help, we deliver straightforward, flexible and affordable solutions to ensure you are better able to meet your investment goals.

The InvestSMART investment philosophy focuses on three key concepts: Lower fees, diversification and investing in a portfolio that aligns with your investment timeframe.

S&P Indices versus Active (SPIVA) research finds that active managers underperform most benchmarks. This underperformance generally aligns with the average cost of management fees, which average around 1.2- 1.7% over time. This implies that higher fees do not necessarily correlate with improved performance - research has shown that it is often the inverse.

Keeping this in mind, InvestSMART builds model portfolios using ETFs and with capped fees. The lower operating costs of ETFs translates into decreased expenses for investors. Fees on a portfolio may seem small, but compound over time and are the biggest detriment to long term performance. Evidence of this can be seen through the widening gap between the performance of InvestSMART portfolios and an average of peer funds. The effect of compounding year on year means it doesn’t take long for the small impact of fees to add up and make a meaningful difference.

You can read more on our fees report and how fees can destroy your wealth here.

We believe that by providing a range of model portfolios for clients across asset classes and with different diversified risk profiles, investors have the option of selecting a model that suits their investment objectives and timeframes. We recognise over the long term, no one asset class if guaranteed to deliver consistent returns. Instead, we offer solutions to build a diversified portfolio to minimise risk without sacrificing returns. Further, by using ETFs, diversification and capping our fees, we are able to remove obstacles commonly faced by investors, that would otherwise impair their ability to meet financial goals. Whilst there will always be risk associated with investing in equity markets, focusing on these three core components can lessen this risk. The performance of our diversified models indicates that this statement holds true.

Ethical investing, also known as socially responsible investing or sustainable investing, is an investment strategy that integrates environmental, social, and governance (ESG) criteria into the decision-making process. This approach allows investors to align their financial goals with their values, promoting responsible corporate behaviour and creating a positive impact on society and the environment.

What is ethical investing?

Ethical investing involves considering a company's financial performance and its impact on society and the environment when making investment decisions. It aims to generate returns while supporting businesses that demonstrate ethical and sustainable practices. Ethical investing can be applied to various asset classes, including stocks, bonds, and ETFs.

Ethical investing as an investment strategy

Ethical investing offers several benefits:

- Aligns investments with personal values: Ethical investing allows individuals to support companies and industries that align with their values and avoid those that do not.

- Mitigates risks: Ethical investments tend to focus on companies with strong ESG performance, which often translates into lower risks and better long-term financial performance.

- Drives positive change: By investing in companies with responsible practices, investors can influence corporate behaviour and promote sustainability.

- Diversification: Ethical investing can provide exposure to new and emerging industries that focus on sustainable solutions, potentially enhancing portfolio diversification.

Understanding the ESG criteria

ESG criteria are a set of standards used to assess a company's ethical and sustainable practices.

You can search the Refinitiv ESG website to see ESG scores for various companies. ESG Scores | Refinitiv

They include:

- Environmental: This focuses on a company's impact on the environment, including pollution, waste management, resource conservation, and climate change mitigation.

- Social: This considers a company's relationships with its employees, suppliers, customers, and communities, evaluating aspects like human rights, labour practices, and diversity.

- Governance: This examines a company's leadership, transparency, and internal controls, encompassing areas such as corporate governance, executive compensation, and shareholder rights.

How to go about ethical investing

There are several ways to incorporate ethical investing into your investment strategy:

- Research: Investigate individual companies and industries to evaluate their ESG performance. Look for companies with strong ESG ratings, certifications, or awards.

- Use ESG-focused funds: Choose mutual funds or exchange-traded funds (ETFs) that specifically focus on companies with strong ESG performance. These funds often have "ESG" or "sustainable" in their names.

- Work with a financial advisor: Seek advice from a financial professional who specializes in ethical investing. They can help you create a personalized investment strategy that aligns with your values and financial goals.

- Shareholder activism: Actively engage with the companies in your portfolio by attending shareholder meetings, voting on proxy proposals, or even submitting your own proposals to promote positive change.

How can InvestSMART Group help?

InvestSMART offers an Ethical Growth Portfolio through its Professionally Managed Account (PMA).

The Ethical Growth Portfolio is invested in a blend of 5 – 15 ethical Exchange Traded Funds (ETFs). Each ETF invests in a different asset class like Australian equities, international equities and fixed income like bonds.

The Intelligent Investor offers an ASX-traded fund called the Intelligent Investor Ethical Share Fund. It has the ticker code ASX: INES.

The Intelligent Investor Ethical Share Fund (ASX:INES) invests in quality businesses managed by insider owners or CEOs who think long-term while considering environmental, social, governance and ethical considerations. It is an actively managed portfolio of 10-35 stocks in one ETF.

In conclusion, ethical investing provides a meaningful way for investors to align their financial goals with their values. By incorporating ESG criteria into their investment decisions, individuals can support responsible companies, drive positive change, and potentially enjoy better long-term financial performance.

For more educational resources about Ethical Investing, you might want to visit:

The Responsible Investment Associate Australasia

Home - Responsible Investment Association Australasia (RIAA)

RIAA champions responsible investing and a sustainable financial system in Australia and New Zealand. It has over 500 members and provides tools for investors.

ETF Filter and Compare Tool at InvestSMART

You can enter Ethical as the search Keyword.

ETFs | Exchange Traded Funds, ETF Investing & Performance (investsmart.com.au)

For InvestSMART's capped-fee diversified portfolios, we endeavour to create portfolios that accurately reflect the risk profiles that investors seek by diversifying across various asset classes. These portfolios range from Conservative, Balanced, Growth, Ethical Growth, to High Growth, with each portfolio designed to achieve the optimal balance between risk and return for its clients. It might seem counterintuitive for InvestSMART to allocate a significant portion of the portfolio to Australian equities; however, there are several justifications for this decision:

Home bias

Home bias is a tendency for investors to prefer investing in domestic assets, as they may have better familiarity and understanding of the local market. This home bias is not unique to Australian investors; it is a phenomenon observed across many countries. By having a significant allocation to Australian equities, InvestSMART caters to its client base's preferences.

Tax benefits

Australian investors may benefit from favourable tax treatments for investing in domestic equities. The dividend imputation system, for example, allows Australian shareholders to receive tax credits on dividends, effectively reducing the tax burden on these investments. These tax benefits can make Australian equities more attractive compared to international equities, leading to a more significant allocation in the portfolio.

Currency risk

By investing in domestic assets, investors can mitigate the currency risk associated with international investments. Fluctuations in exchange rates can impact the returns on international assets. By having a significant portion of the portfolio in Australian equities, InvestSMART helps its clients manage this risk.

Diversification within Australian equities

The Australian stock market encompasses many companies operating across diverse sectors, including finance, resources, and healthcare. Investing in a broad array of Australian equities, such as the entire ASX200 Index through an ETF like ASX: IOZ, InvestSMART can attain a considerable degree of diversification within this asset class. Consequently, this approach helps safeguard the portfolio against sector-specific risks.

A broad range of investment portfolios

InvestSMART acknowledges that clients have varying investment goals, timeframes, and risk profiles. To accommodate these diverse requirements, the firm provides an array of investment portfolios and strategies for clients to choose from based on their own understanding of their preferences and needs. InvestSMART does not offer personalised financial advice but empowers clients with a selection of investment options, allowing them to make informed decisions on which portfolio best aligns with their circumstances. This approach ensures that InvestSMART caters to a wide variety of client requirements without providing tailored financial advice.

In summary

While it might seem unusual for InvestSMART to have a significant allocation to Australian equities within their diversified investment portfolios, there are valid reasons for this decision. These include home bias, tax benefits, currency risk management, diversification within the asset class, and an extensive range of investment portfolios. However, it is essential for investors to understand their own risk tolerance and investment objectives and to carefully consider their options when selecting a portfolio to ensure appropriate diversification.

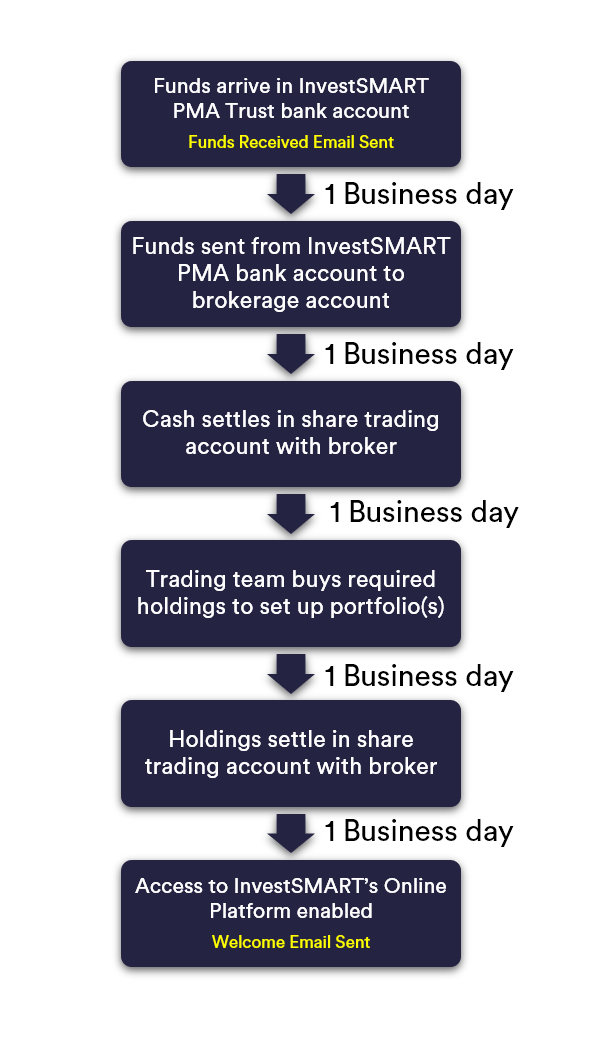

When you BPAY your funds before 6 pm on a business day, they will typically arrive in our PMA Trust Account the following business day.

We will email you that we have received your partial or total funds, depending on the amount you have sent.

Once we have received the total funds for investment, we will then send your funds to the share brokerage account opened in your name. This transfer typically takes overnight as well.

When your funds arrive at the share broker the next business day, we will begin to purchase holdings in line with your chosen portfolio.

Once the shares/ETFs have settled (T+2), we will enable the online platform for you to view and administer your holdings. We will send you a welcome email explaining how to access the online platform.

This process takes about 4-5 business days from when we receive your total funds.

Why does it take 4-5 business days and not immediately?

We're proud to offer low and capped management fees for our InvestSMART investment products. At the heart of everything we do, our purpose is to make investing rewarding, accessible and affordable.

To keep fees low and capped, we take a process-driven approach. For instance, our trading team can keep costs down by trading once a day during a specific period. This means that funds received are actioned the following business day.

Settlement periods

As with any ASX listed share or ETF, there is a two business days settlement period. The ASX explains this here. This settlement period means your holdings won't settle until two days after the transaction takes place.

Your investments are held in a CHESS sponsored brokerage account. This adds an extra layer of protection and can offer more tax advantages as you can transfer holdings to your share trading account and not be forced to sell them. However, this means that getting funds from your bank account to the brokerage bank account adds an extra step. We are in the process of investigating CMA accounts to improve this.

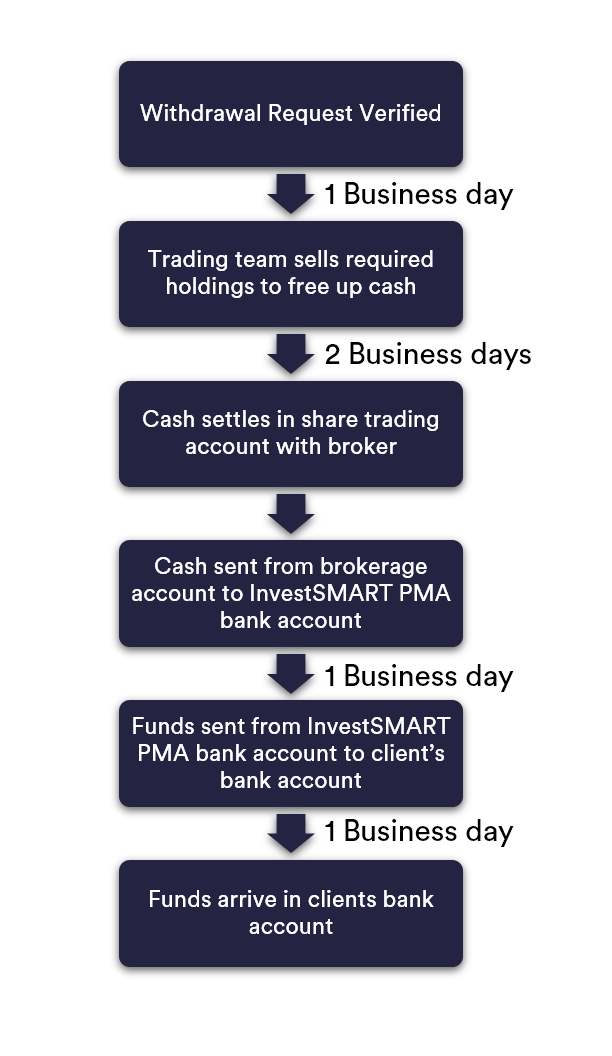

Withdrawals typically take 4-5 business days from the day you verified the withdrawal request.

Because of the delay with data reflected in the My Account section, you may see your cash component in your PMA larger than usual.

This increased cash holding is temporary and shows that the cash has been 'freed up' and will shortly be sent to your nominated bank account.

Why does it take 4-5 business days and not immediately?

We're proud to offer low and capped management fees for our InvestSMART investment products. At the heart of everything we do, our purpose is to make investing rewarding, accessible and affordable.

To keep fees low and capped, we take a process-driven approach. For instance, our trading team can keep costs down by trading once a day during a specific period. This means that withdrawal requests that are verified and submitted are actioned the following business day.

Settlement periods

As with any ASX listed share or ETF, there is a two business days settlement period. The ASX explains this here. This settlement period means your funds won't be available until two days after the transaction takes place.

Your investments are held in a CHESS sponsored brokerage account. This adds an extra layer of protection and can offer more tax advantages as you can transfer holdings to your share trading account and not be forced to sell them. However, this means that getting funds from your brokerage bank account to the InvestSMART bank account adds an extra step. We are in the process of investigating CMA accounts to improve this.

What can I do to help?

Please be aware of the four to five day withdrawal period and factor in potential public holidays that may extend the process.

Intelligent Investor Ethical Share Fund (INES)

INES is a managed fund listed on the ASX. This managed fund follows the Intelligent Investor analyst team's research to invest in a portfolio of 20 - 30 ASX-listed companies using an ESG filter. The fund only invests in ASX-listed companies and holds cash. To invest, you will use the code INES to purchase units via your brokerage account, through an InvestSMART PMA, or during secondary offer periods.

InvestSMART Ethical Growth Portfolio

Ethical Growth is a managed portfolio offered via InvestSMART's Professionally Managed Account (PMA) service. As the PMA is a managed account, investors own the direct investments which make up the investment portfolio. The InvestSMART Ethical Growth Portfolio holds exchange-traded funds (ETFs) with an ESG overlay. These ETFs range across multiple asset classes, e.g. Australian shares, international shares, cash etc.

Here are some key differences:

|

|

InvestSMART Ethical Growth Portfolio |

Intelligent Investor Ethical Share Fund (INES) |

|---|---|---|

|

Investing Strategy |

Passive |

Active |

|

Are the management fees capped? |

Yes (see Capped Fees) |

|

|

How do you invest in this? |

You can only invest through a PMA online. |

You can buy through your share broker on the ASX (INES) or invest through a PMA. |

|

Is there a minimum investment amount? |

From $500 with your share broker. |

|

|

Diversified? |

Yes |

Only Australian Equities |

| Can be used with Fundlater? | Yes | No |

|

More information |

See Product Page |

See Product Page |