- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

- Cashback FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

How do the InvestSMART Professionally Managed Accounts work

Choosing the right portfolio depends on your investment goals, time frame, and risk tolerance. To help you decide, consider the following:

1. Investment Time Frame: Each portfolio has a suggested time frame. Ensure it aligns with your financial goals:

2. Target Market Determination (TMD): Review the PMA Target Market Determination to understand the intended investor profile for each portfolio.

3. Tools & eBook Guides: InvestSMART provides several resources to help you choose the right portfolio.

Here is a list of tools and guides to help select the right portfolio:

- InvestSMART's Statement of Advice – A tailored Investment Plan with step-by-step guidance.

- Guide to Growing Wealth – Strategies to build your portfolio.

- Guide to Investing in Retirement – Insights for managing your investments during retirement.

- Investor Pack – A comprehensive overview of InvestSMART’s offerings.

Calculators:

- Wealth Savings Calculator

- Property Savings Calculator

- Education Savings Calculator

- Retirement Savings Calculator

For a deeper dive into investing, explore InvestSMART Bootcamp, a complete investment course designed to help you get started.

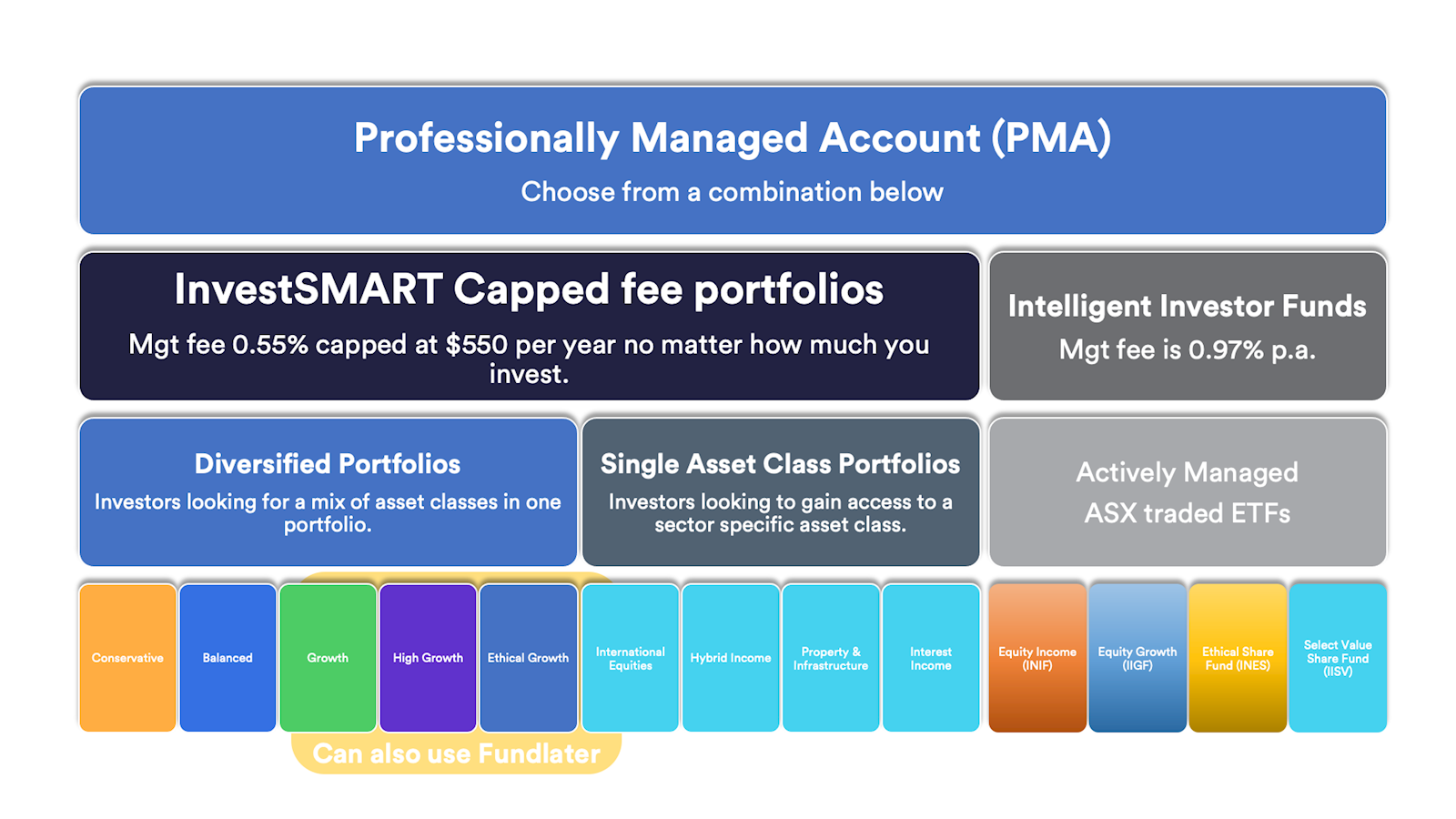

The InvestSMART Professionally Managed Account (PMA) is established and offered within the registered managed investment scheme known as the Professionally Managed Accounts.

Each investor has a separate account to which their investments are allocated. You will require a different PMA for each investment entity you have e.g. individual, joint, SMSF etc.

A client will open an InvestSMART PMA and can then choose between the various InvestSMART Diversified Portfolios. An account can hold one or more models but can only hold one diversified portfolio. The management fee is charged at the account level, not per portfolio.

Once you decide which model portfolio(s) are best suited to your investment needs and objectives, we will purchase the investment to be included in your account to reflect the model portfolio or combination of model portfolios that you have selected.

Yes, you can hold multiple portfolios within a single account but you can only hold one diversified portfolio per Professionally Managed Account (PMA) with single asset class portfolios alongside it. For example, you could hold the InvestSMART Growth Portfolio with both the InvestSMART International Equities Portfolio and InvestSMART Hybrid Income Portfolio alongside it but you could not hold both the InvestSMART Growth Portfolio and InvestSMART Balanced Portfolio in the single Professionally Managed Account (PMA).

If you wish to invest in multiple diversified portfolios then you will be required to open multiple Professionally Managed Accounts (PMAs).

Diversified Portfolios

- InvestSMART Conservative

- InvestSMART Balanced

- InvestSMART Ethical Growth

- InvestSMART Growth

- InvestSMART High Growth

Single Asset Class Portfolios

- InvestSMART International Equities

- InvestSMART Australian Equities

- InvestSMART Property & Infrastructure

- InvestSMART Hybrid Income

- InvestSMART Cash Securities

- InvestSMART Interest Income

Intelligent Investor Funds

- Intelligent Investor Growth Fund

- Intelligent Investor Income Fund

- Intelligent Investor Ethical Fund

- Intelligent Investor Select Value Fund

When you open an InvestSMART Professionally Managed Account (PMA), you choose from InvestSMART's range of Diversified Portfolios to invest in.

A list of the portfolios can be found here.

These managed portfolios comprise of Exchange Traded Funds (ETFs) or, in some cases direct shares. In particular, the InvestSMART Hybrid Income Portfolio invests in Australian listed hybrids and listed debt securities.

What is an Exchange Traded Fund?

An Exchange Traded Fund, or ETF, is a managed fund that trades on the stock market.

There are different types of ETFs, each with its own purpose, but most commonly, they will track or follow a particular index.

For example, if you want to follow or track the S&P ASX 200 (the top 200 Australian shares by market capitalisation), you could either buy each individual share (200 shares) or one ETF. The one ETF wraps up the 200 shares into one holding. By holding this one ETF, you get exposure to the movements of the ASX 200, less any fees.

Investing in ETFs is a form of passive investing, and they generally incur cheaper management fees, as fewer investment decisions are required to manage an ETF. They are also quite liquid and traded easily on an exchange.

You can see the holdings of each InvestSMART managed portfolio by navigating to its product page and scrolling to Key Facts > Holdings.

Yes, all investments held within your InvestSMART PMA are held in your name (or chosen entity e.g. SMSF) in a CHESS sponsored broking account.

You are the registered legal and beneficial owner of a portfolio of securities. You can log into the investor website at any time to view the individual securities that make up your Account.

Rebalancing within your InvestSMART PMA is an automatic process whereby model portfolios are compared against the investors’ accounts. The portfolios are monitored on a daily basis, reviewed monthly and reviewed by the Investment Committee formally every quarter.

We aim to keep transactions to a minimum and allow the asset classes to provide the return rather than chopping and changing out of investments.

Your Account will only be rebalanced in the following circumstances:

- The Portfolio Manager decides to rebalance or switch out a holding;

- You add cash or remove cash from your account;

- You switch Model Portfolios or make other alterations to your Account; or

- Where your cash percentage has moved away from the model portfolio percentage due to dividends received or fees paid.

Investors can see the transactions via the Transactions section when logged in.

This is the most common question we get from experienced and inexperienced investors alike.

No matter when you are looking to invest, there will always be something in the news that will have you asking this question. Whether it is a commentary on our local housing market, geopolitical uncertainty, or fears of a global pandemic. Uncertainty is constant, yet history shows us investment markets and asset classes continue to grow over the long term.

Having an investment plan and sticking to it is far more important than picking the exact day or week to invest. Developing good investment habits by investing for the long-term, in the right mix of asset classes, adding to your investment over time and rebalancing in a systematic fashion will see you reach your goal. In addition, chopping and changing your portfolio will chew up returns with transactions costs and potentially reduce your invested capital by paying additional taxes.

InvestSMART can help you select and stick to a plan:

-

Provides simple contribution and income reinvestment options

-

Transparent online monitoring through your 'My Account'

-

Consolidated annual tax reporting direct to your inbox

- CHESS sponsored ownership of your portfolio holdings

- Our famous low fees starting at just under $1 a week, capped* at $880 per year. See more on Fees here.

No, you can only hold InvestSMART portfolios or Intelligent Investor ETFs.

InvestSMART does not allow investors to transfer existing shares, holdings, or assets, into a Professionally Managed Account (PMA) to facilitate initial funding, contributions or withdrawals.

We believe this decision is in the best interest of our clients for the reasons below.

Cost

Transferring shares, called an in-specie transfer, can be costly. Brokerage services will charge a fee between $30 and $90 per security to cover the time needed to facilitate the transfer.

For example, transferring 15 stocks could cost between $450 and $1,350.

Administration

Unsurprisingly there is a lot of paperwork involved for the investor, us and the current broker holding the shares on their platform.

Investors are required to sign, scan and return a transfer request for each security along with a detailed cost base breakdown to ensure that tax implications are calculated accurately on any future transactions.

Lag Period

Share transfers require not only all the paperwork to be completed by the investors, but paperwork and administration to be acted upon by the brokerage service transferring the shares and the brokerage service receiving the shares.

It is not uncommon to see this process take anywhere from 2 weeks to 2 months, during which your investments are in limbo, which is dangerous should there be short-term volatility and you wish to trade upon them.

Alignment

We do not expect that many clients will hold the same investments or weightings as the Model Portfolio(s) they have selected for their Professionally Managed Account (PMA).

What this means is that even once you have paid the transfer fees, completed the paperwork and waited for the process to be finished - it is still very likely that we will need to sell some, or all, of your shares to rebalance your investments based on the Model Portfolio(s) that you selected.

We want to make your transition to investing with us as easy as possible, so please feel free to contact us at invest@investsmart.com.au

If you are an existing investor you would open a new InvestSMART Professionally Managed Account (PMA) is if you are investing via a different entity, for example you have a personal account but also wish to invest in joint names or an in your self-managed super fund, or if you are wanting to invest in multiple diversified portfolios.

As an existing investor you can add funds to your existing PMA or add a new investment portfolio to your PMA via the Add Funds feature in My Account.

Here are some examples of when you would open a new account:

- You're a new client with no account

- You want to change or open an account under a different legal entity like a company, trust, or SMSF

- You want to add your partner as a legal owner

- You want to invest in multiple diversified portfolios

- You previously closed your account

The current minimum investment amount for the InvestSMART Professionally Managed Account (PMA) starts at $10,000 per model portfolio; unless otherwise stated in the Investment Menu, Key Facts section of the online information page or the Key Details section of the Investor Pack.

If you already have an InvestSMART PMA and just wish to add to your existing investment model, you do not require another $10,000 to contribute to that same investment.

Example: In your InvestSMART PMA you have $15,000 in the InvestSMART Conservative Portfolio and $11,000 in the InvestSMART Interest Income Portfolio.

You wish to withdraw $6,000 from the total portfolio.

Each portfolio requires a $10,000 minimum balance, so $5,000 would be withdrawn from the InvestSMART Conservative Portfolio and $1,000 from the InvestSMART Interest Income Portfolio.

Yes, you can withdraw your funds at any time using the Withdrawal Request feature via the My Account section.

Your investments are not subject to a minimum investment period, and there is no exit fee.

You should, however, always consider the suggested timeframe of your chosen model portfolio(s) and associated brokerage charges to sell your holdings.

The holdings are very liquid and trade as ETFs on the ASX.

We usually have funds returned to clients in 4-5 business days from the submitted withdrawal request. Withdrawal requests are processed the following day they're received.

If you have multiple model portfolios in your InvestSMART PMA you can choose which investment the funds are drawn from via the Withdrawal Request section.

Yes. You will receive a comprehensive tax statement at the end of financial year and you will receive the franking you're entitled to once you submit your tax return.

As cash is added to the your account, the cash holding percentage will increase while all other asset classes will decrease as a percentage. The change in asset percentages will bring the client’s account out of sync with the model, and transactions will need to take place to realign it.

Whether or not we transact will depend on how out of sync the account is compared to the model. For example, adding $1,000 to a $1M account will not move the needle but adding that amount to a $10K account will. We will use the excess cash to buy more holdings and realign the account to the model.

We will generally buy the underlying ETFs one business day following the receipt of added funds appearing in your brokerage account.

Keep in mind, your InvestSMART account updates each day on the closing balances from the day before.

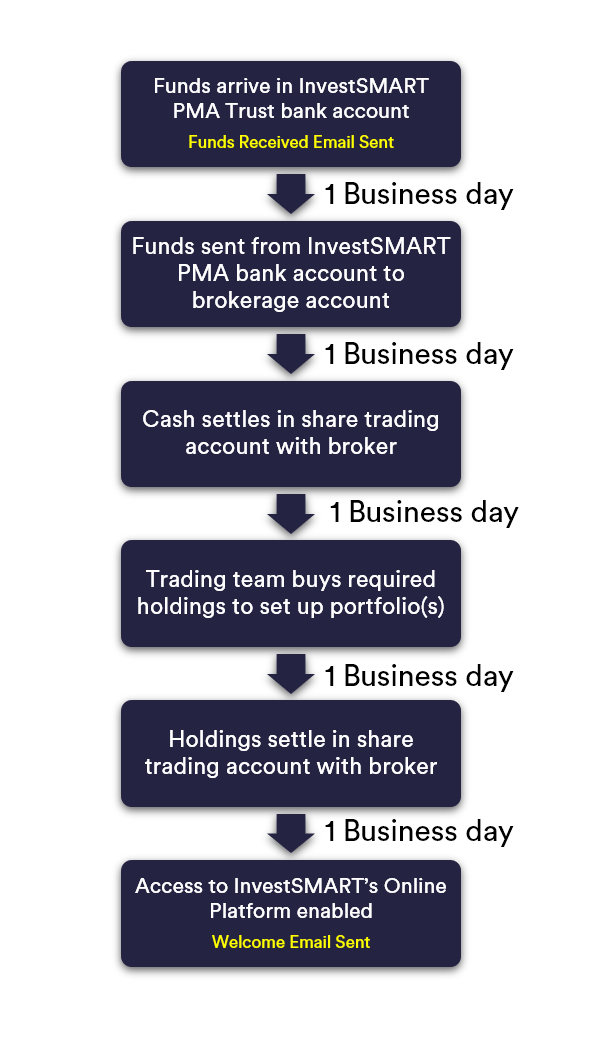

When you BPAY your funds before 6 pm on a business day, they will typically arrive in our PMA Trust Account the following business day.

We will email you that we have received your partial or total funds, depending on the amount you have sent.

Once we have received the total funds for investment, we will then send your funds to the share brokerage account opened in your name. This transfer typically takes overnight as well.

When your funds arrive at the share broker the next business day, we will begin to purchase holdings in line with your chosen portfolio.

Once the shares/ETFs have settled (T+2), we will enable the online platform for you to view and administer your holdings. We will send you a welcome email explaining how to access the online platform.

This process takes about 4-5 business days from when we receive your total funds.

Why does it take 4-5 business days and not immediately?

We're proud to offer low and capped management fees for our InvestSMART investment products. At the heart of everything we do, our purpose is to make investing rewarding, accessible and affordable.

To keep fees low and capped, we take a process-driven approach. For instance, our trading team can keep costs down by trading once a day during a specific period. This means that funds received are actioned the following business day.

Settlement periods

As with any ASX listed share or ETF, there is a two business days settlement period. The ASX explains this here. This settlement period means your holdings won't settle until two days after the transaction takes place.

Your investments are held in a CHESS sponsored brokerage account. This adds an extra layer of protection and can offer more tax advantages as you can transfer holdings to your share trading account and not be forced to sell them. However, this means that getting funds from your bank account to the brokerage bank account adds an extra step. We are in the process of investigating CMA accounts to improve this.

Yes. Under the Professionally Managed Account (PMA), all investors are the registered and beneficial owners of the investments held in a CHESS sponsored account.

Under the Professionally Managed Account (PMA), all investors are the registered and beneficial owners of the investments held in a CHESS sponsored account.

If anything occurred to see InvestSMART cease operations, your investments would still remain in the name of the investor and/or entity listed as the Professionally Managed Account (PMA) holder.

You would then be able to facilitate the transfer of your investments to another CHESS sponsored account that you have access to and control over to continue to manage your investments.

Your privacy and security are our top priority.

Our bank-level web security keeps your information safe and secure (for the geeks out there, that’s our 256-bit SSL/TLS certificate).

Your investments are held safely in your own name under your own individual Holder Identification Number (HIN).

We never share your personal information with unrelated third parties or advertisers.

You can change your bank account details online here.

Or login and go to Dashboard > More > Bank Account Details.

You can also check your current bank account details.

Please note: We have an enhanced level of security when changing bank details.

To change these bank details:

-

Enter the last four (4) digits of your current bank account number.

-

Add the name of who holds this bank account in New Account Name

-

Enter the BSB

-

Enter the new account number

-

Scroll to the bottom of the page and click Save Preferences

-

You will be asked to verify using a code sent to either your mobile phone or email address.

Security Process for Changing Bank Details

After you have completed the steps above, please follow this additional security process to ensure the safety of your account:

-

Send a copy of your bank statement showing the account holders name(s) and the BSB/ account number.

-

Email the statement to invest@investsmart.com.au, making sure that the name of the bank account holders matches the PMA holders.

-

We'll give you a call on your registered phone number to confirm that you're the one requesting the change.

By completing these additional steps, we can further ensure the security of your account when changing bank details.

What is 2FA?

Two-factor authentication (2FA) - or two-step verification - is a security feature that adds an extra layer of protection to your account. Instead of using a single factor to authenticate your identity, like a password, you can use a second, one-time code sent to you via SMS or generated in an authenticator mobile application like Google Authenticator, Microsoft Authenticator or Authy

How do I enable 2FA?

The 2FA system is opt-in. To activate it, please read the following steps.

1. Accessing 2FA

- Click here or go to My Account,

- Then click 2 Factor Authentication under My Security.

2. Choose a Verification Method

- Get a code via SMS/text or

- Generate a code via an Authenticator App like Google Authenticator, Microsoft Authenticator or Authy.

You can choose both methods. If you enable both, the authenticator app will be used as the primary method.

Method for turning on the SMS/Text Message:

-

Turn on the SMS/Text Message toggle.

-

An SMS/text is sent to your mobile device with a code

-

Enter the code and click the “Verify & Save Setting” button.

-

An ‘All Done’ message will appear confirming your SMS authentication is set up

Method for turning on the Authenticator Application:

-

Turn on the Authenticator Application toggle

-

Download the Authenticator of choice and then use the generated QR code

-

Enter the code and click the “Verify Code” button.

-

An ‘All Done’ message will appear confirming your Authenticator App is set up

Once you have activated your two-factor authentication (2FA), you will now have an extra step at login. As usual, your first step will be entering your email and password combination. The second step will require you to enter a valid 2FA code from either the SMS you receive or generate the code via your authenticator app of choice.

.png)

3. Logging in with 2FA

- Logging in will require your email and password, as well as a 2FA code from your chosen method.

- Optional: Select “Don’t ask again on this device for 30 days” to skip 2FA on that device/browser for a month.

- With 2FA enabled, you should bypass the Google reCAPTCHA step at login.

Need help?

If you have any questions or need further assistance, please click on the salmon-coloured help button in the bottom right-hand corner of the page.

This help button will begin a live chat with a team member during office hours. If your query is outside office hours, we will get back to you as soon as possible.

.png)