The magic of Compound Interest

The great scientist Albert Einstein once described compound interest as the ‘eighth wonder of the world’. He said, ‘He who understands it, earns it, and he who doesn’t, pays for it’.

Compound interest is also known as ‘interest on interest’. It occurs when we add the interest earned to the principal sum, such that in following periods, interest is charged on the combined amount.

Benjamin Franklin explained the idea best when he said, ‘Money makes money. And the money that money makes, makes money’.

For example, suppose we start with $1,000 and we earn 10% interest on that amount. After one year we earn $100 interest, which when added to our capital gives us $1,100. The next year we earn $110 interest, which lifts our capital to $1,210. The following year we earn $121 interest, which lifts our capital to $1,331, and so on.

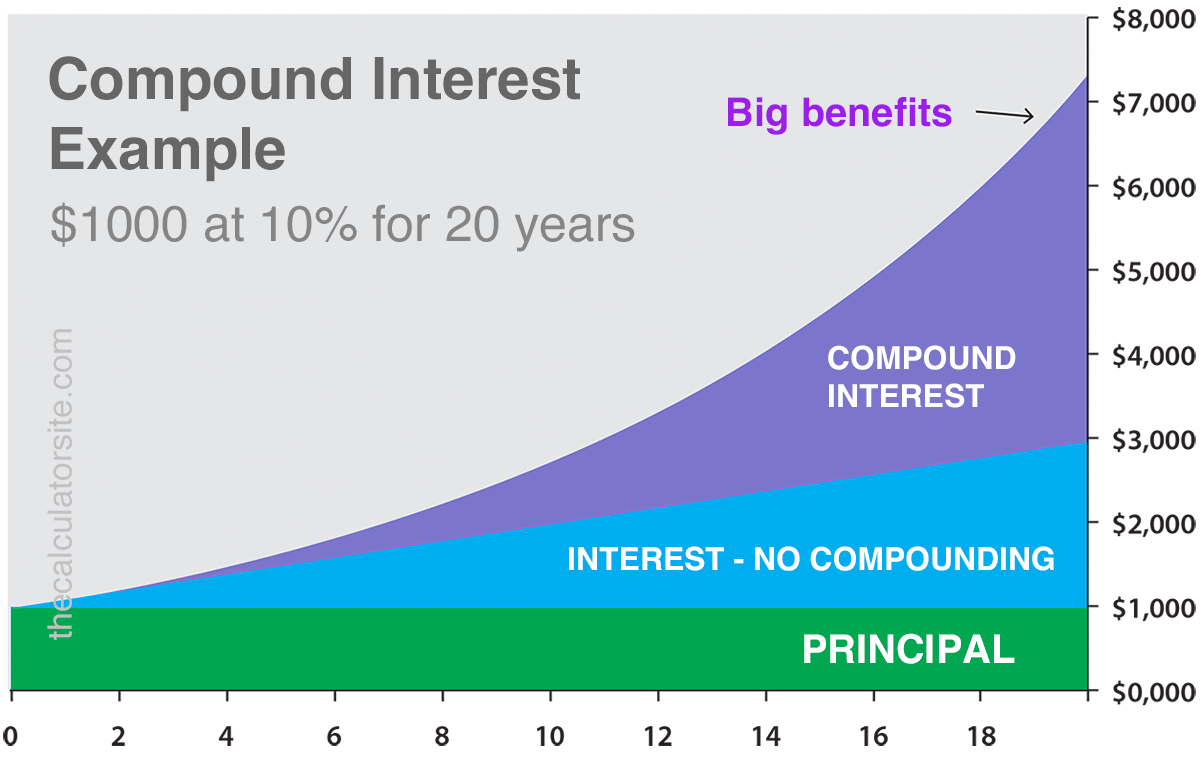

If we continued this for 20 years, we would have $6,727, and over 50 years, we would have $117,391.

Where it gets interesting, is that if we start with $10,000 instead of 1,000, then our final amount will be ten times greater. And if we can contribute regularly along the way, this too provides a major boost to our final amount.

The graph below shows what happens when interest is compounded. Notice that the big benefits occur near the end of the time period. This is why Charlie Munger said, ‘The first rule of compounding is to never interrupt it unnecessarily’.

Source: The Calculator Site

Investing

Investors can compound their wealth in several ways. The simplest way is to buy quality companies, active funds, or ETFs that grow over time.

Another way to compound wealth is by reinvesting dividends. This may be via a DRP (Dividend Reinvestment Plan), where the investor receives new shares in the company in lieu of cash. Alternatively, an investor can use their cash dividends to buy other stocks or ETFs to add to their portfolio.

Investors can also buy into certain growth companies that retain their earnings to invest in growth projects within the company. This has the effect of increasing company profits in future years. In this way some companies can themselves become compounding machines.

A Compounding Machine

Warren Buffett often credits compounding as a great way to build wealth. His life story is an example of how compounding works.

Buffett bought his first stock at age 11, and as a teenager made money selling newspapers. By the time he was 21 he had amassed around US$20,000. At age 25, Buffett started his investment partnership, and by age 30 his fortune had grown to $1m. At age 35, he bought a controlling stake in Berkshire Hathaway, and by age 39 his wealth had grown to US$25m. By age 52, this wealth had increased to US$376m.

Today his fortune stands at around US$113bn, with his wealth compounding at an average rate of around 20% p.a. over his lifetime (around 9.5% above the S&P 500).

What may be surprising, is that due to the nature of compounding, around 99.7% of his wealth was earned after age 52.

Start the journey

Money is not the only thing that compounds. Our knowledge also compounds over time, and that’s why the earlier we start reading and learning the skills of investing, the better.

When buying stocks or ETFs, we should also start early, invest well, and hold for the long-term, and the magic of compounding will happen.

Charlie Munger said, ‘Getting wealthy is like rolling a snowball. It helps to start on top of a long hill. Start early and try to roll that snowball for a very long time’.

Frequently Asked Questions about this Article…

Compound interest, often described as 'interest on interest', is crucial for investors because it allows your investment to grow exponentially over time. By reinvesting the interest earned, you can significantly increase your wealth, especially if you start early and invest for the long term.

Compound interest works by adding the interest earned to the principal sum, so future interest is calculated on the new total. For example, if you start with $1,000 and earn 10% interest, you'll have $1,100 after one year. In the second year, you'll earn interest on $1,100, and so on, leading to substantial growth over time.

Investors can benefit from compounding by buying quality stocks, ETFs, or funds that grow over time, reinvesting dividends through a Dividend Reinvestment Plan (DRP), or investing in growth companies that reinvest their earnings to boost future profits.

Starting early is crucial for compounding because the longer your money is invested, the more time it has to grow exponentially. As Charlie Munger said, 'Getting wealthy is like rolling a snowball. It helps to start on top of a long hill.'

Warren Buffett used compounding by starting to invest at a young age and consistently reinvesting his earnings. His wealth grew significantly over time, with around 99.7% of his fortune earned after age 52, thanks to the power of compounding.

Dividends play a significant role in compounding wealth by allowing investors to reinvest their earnings. Through a Dividend Reinvestment Plan (DRP), investors can receive additional shares instead of cash, further increasing their investment's growth potential.

Yes, knowledge can compound over time just like money. The earlier you start learning about investing and financial skills, the more you can benefit from the accumulated knowledge, enhancing your investment decisions and potential returns.

The key takeaway for everyday investors is to start investing early, reinvest earnings, and hold investments for the long term. By doing so, you can harness the magic of compounding to significantly grow your wealth over time.