Are you earning what you're worth?

Plenty of Australians are doing it tough right now thanks to a string of rate hikes and inflation that’s sitting at 6.1%. That’s seeing a lot of belt tightening, but there is another solution to managing a money squeeze. It involves looking at the other side of the ledger – what you earn.

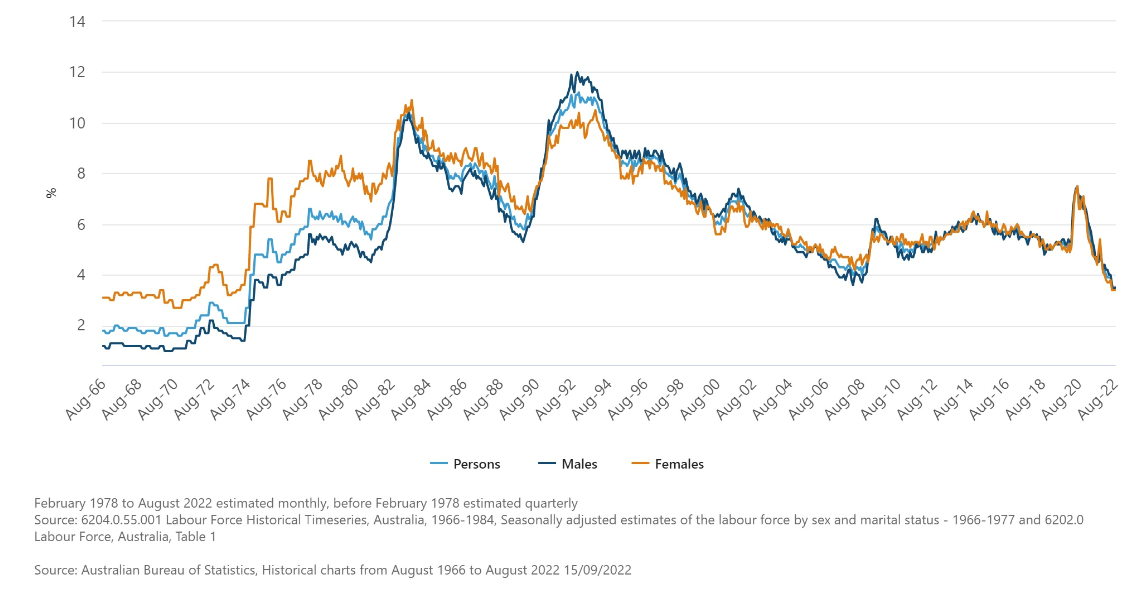

The good news, for workers at least, is that Australia has a very tight labour market right now. The unemployment rate is an exceptionally low 3.5%[1]. As the graph below shows, we haven’t seen unemployment rates at this level since the 1970s. Better still, all workers are benefitting – both male and female.

|

Unemployment rate Australia, August 1966 to August 2022 seasonally adjusted |

|

|

Such a tight labour market means employers can struggle to fill roles. And in the true spirit of supply and demand, this is seeing businesses offer higher wages to attract new recruits.

Wage growth for new jobs hits 3.8%

The latest data from employment marketplace SEEK shows advertised salaries are up 3.8% over the year to August[2]. That’s a lot more than the 2.6% increase in the Wage Price Index[3]. It goes to show that looking for a new job could mean pocketing a pay rise.

But it could pay to act sooner rather than later. As the chart below confirms, the wage premium offered to jobseekers is starting to dial down.

|

Annual growth of SEEK Advertised salary Index |

|

|

4 out of 5 bosses expect staff to ask for a pay rise

Of course, earning more doesn’t have to be as drastic as pulling stumps on your current role.

If you like your job and have a decent career path, it can make sense to have a chat with the boss about an uptick in pay, especially if you’ve made a strong contribution to the business throughout the year.

Making a request for a pay rise isn’t always easy. But chances are your employer won’t be surprised if you turn the conversation around to talk of higher pay. A survey by recruitment firm Robert Half found four out of five (81%) business leaders are expecting more employees to ask for a pay rise in 2022.

The same study found almost all (96%) employers are increasing their salary budgets this financial year – by an average of 20%.

That said, it pays to be realistic about your employer’s capacity to deliver higher pay. The lowest paid roles, which tend to be in retail and hospitality, have seen wages growth of 3.4% this year. Businesses in these sectors work off very tight margins, and some employers simply can’t afford to increase their staff’s pay.

Know your market value

What matters is that you know your worth – it’s a good starting point for pay negotiations no matter whether you are looking for a new job or staying in your current role.

SEEK has an online salary look-up tool, and many of the big recruiters like Robert Half and Hayes publish annual salary guides for various professional roles. Or check out the PayScale website for hourly pay rates across a variety of jobs.

The catch of working multiple jobs

For a growing number of Australians, navigating higher living costs has meant holding down two or more jobs. The Australian Bureau of Statistics recently reported that 900,000 Australians are working multiple jobs – the highest level since 1994.

However, there is a risk that some of these workers could face a tax debt when they lodge their next tax return. Let me explain. For Australian residents, the first $18,200 of income you earn is tax-free. This tax-free threshold is equivalent to earning:

- $350 a week

- $700 a fortnight

- $1,517 a month.

The drawback is that the tax-free threshold only applies once. If you have two jobs, both employers will likely deduct tax from your wage on the assumption that you’re entitled to the tax-free threshold – unless they’re advised otherwise. This could mean that by the end of the financial year you’ve paid considerably less tax than required.

That’s why the Tax Office advises letting a second (or third) employer know they should withhold tax from your income at the higher, 'no tax-free threshold' rate. Yes, this can cut into your take-home pay from a second job. You may even find it’s not financially worthwhile working two jobs. But that could be a whole lot better than being lumbered with an unwanted tax debt that you struggle to repay.

[1] https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release#:~:text=Unemployment-,In seasonally adjusted terms, in August 2022:,1.8 pts below March 2020.

[2] https://www.seek.com.au/about/news/seek-advertised-salary-index-advertised-salaries-grew-by-38-in-year-to-august-2022

[3] https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/wage-price-index-australia/latest-release

Frequently Asked Questions about this Article…

In a tight labour market, you can increase your earnings by exploring new job opportunities, as employers are offering higher wages to attract talent. Alternatively, you can negotiate a pay rise with your current employer, especially if you've made significant contributions to the business.

As of the latest data, Australia's unemployment rate is at an exceptionally low 3.5%, a level not seen since the 1970s. This indicates a very tight labour market.

The average wage growth for new jobs in Australia is currently 3.8%, according to data from employment marketplace SEEK. This is higher than the 2.6% increase in the Wage Price Index.

To determine your market value, you can use online salary look-up tools like SEEK, or refer to annual salary guides published by major recruiters such as Robert Half and Hayes. PayScale is also a useful resource for checking hourly pay rates across various jobs.

Before taking on multiple jobs, consider the potential tax implications. The tax-free threshold only applies once, so you may end up with a tax debt if both employers assume you're entitled to it. Inform your second employer to withhold tax at the higher rate to avoid this issue.

Yes, a survey by recruitment firm Robert Half found that four out of five business leaders expect more employees to ask for a pay rise. Additionally, almost all employers are increasing their salary budgets this financial year.

The risk arises because the tax-free threshold applies only once. If both employers deduct tax assuming you're entitled to the threshold, you might pay less tax than required, leading to a potential tax debt. It's advisable to inform your second employer to withhold tax at the 'no tax-free threshold' rate.

The retail and hospitality sectors have experienced the lowest wage growth, with an increase of 3.4% this year. These sectors often operate on tight margins, limiting their ability to offer higher pay.