Are recessions a good time to invest?

When it comes to past recessions, the Mark Twain quote, ‘History never repeats, but it often rhymes’ certainly applies. No two recessions have ever been the same, but they often have similar characteristics.

Recessions are defined technically as two continuous quarters of negative GDP growth, but they are also known as a significant and widespread downturn in economic activity that lasts for a sustained period.

Many economies have recessions every seven to ten years, but in Australia we have had slightly fewer due to our resources sector and proximity to China. Our most recent technical recession was after the covid crash in 2020.

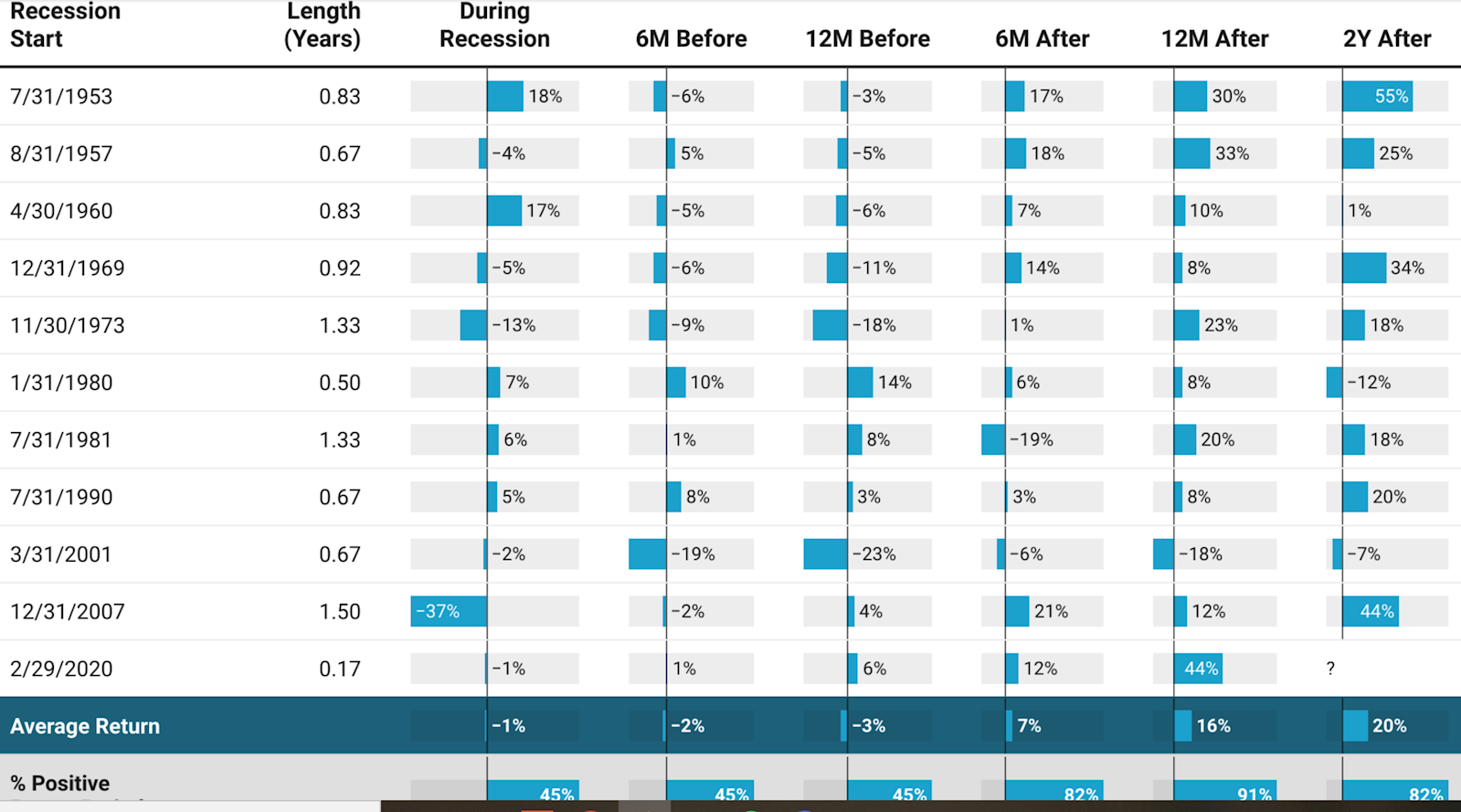

As per the below chart from Darrow Investment Management, in the US they have had 11 recessions since 1948, and the chart shows how the S&P 500 fared through each of these recessions.

Please note that the returns on the chart are cumulative (actual) returns, and not annualised returns.

The chart shows some interesting patterns. In the 12 months before a recession occurs, the S&P 500 on average fell 3%. During a recession, the results were mixed, with the market having ups and downs, but on average dropping 1%. However, after a recession, the market almost always makes good gains, with the market rising on average 20% after two years.

Though these results are probably what you’d expect, it’s still interesting to see it visualised, as it shows what may happen when we move out of the current downturn.

Navigating Recessions

For an investor living through a recession, there’s always plenty that’s not clear, including its length and depth. There are also unknowns about whether further unexpected events could see the market move even lower.

What we do know is that recessions are often great opportunities for investors. With stock prices depressed, buying can improve the chances of gains when the markets correct.

In 2018, Buffett said, ‘The best chance to deploy capital is when things are down’.

The Pendulum

Famed investor Howard Marks often speaks about the market pendulum, and how it swings from the positive to the negative, then back to the positive.

The important thing is to be in the market when the pendulum does eventually swing back. Taking a ‘wait and see’ approach, can result in you missing the first five or so percentage points of the rebound.

One of the key takeaways from the chart, is that if you want to pick up the good returns seen after a recession, you must be in the market.

The InvestSMART & Fundlater Investment Committee does not try to predict upcoming economic events. Instead it focuses on creating diversified portfolios in line with the stated risk profile and recommended timeframe. Talk with the team today via the chat function in the bottom right-hand corner about our investment approach.

Frequently Asked Questions about this Article…

A recession is technically defined as two consecutive quarters of negative GDP growth. It's a significant and widespread downturn in economic activity that lasts for a sustained period. Many economies experience recessions every seven to ten years, although Australia has had slightly fewer due to its resources sector and proximity to China.

Historically, the S&P 500 has shown mixed results during recessions. On average, it fell 3% in the 12 months before a recession and dropped 1% during a recession. However, after a recession, the market typically rebounds, rising on average 20% after two years.

Yes, recessions can be great opportunities for investors. With stock prices often depressed, buying during a recession can improve the chances of gains when the markets recover. As Warren Buffett said, 'The best chance to deploy capital is when things are down.'

The market pendulum, a concept often discussed by Howard Marks, refers to how the market swings from positive to negative and back to positive. Being in the market when the pendulum swings back to positive is crucial, as waiting can result in missing the initial rebound gains.

Staying invested during a recession is important because it positions you to benefit from the market rebound. If you wait too long, you might miss the first few percentage points of the recovery, which can significantly impact your overall returns.

The InvestSMART & Fundlater Investment Committee does not try to predict economic events. Instead, they focus on creating diversified portfolios that align with the stated risk profile and recommended timeframe, ensuring a balanced approach to investing during downturns.

Investors should consider the uncertainty of a recession's length and depth, as well as the potential for unexpected events. However, they should also recognize the opportunity to buy stocks at depressed prices, which can lead to gains when the market corrects.

You can learn more about investment strategies during a recession by talking with the InvestSMART & Fundlater team. They offer a chat function on their website where you can discuss their investment approach and how it aligns with your financial goals.