What is diversification?

Diversification is one of the most important principles of successful investing. In its simplest form, diversification is the practice of spreading your money across different types of investments. It helps to reduce risk in your investment portfolio and smooth out the highs and lows of investment markets. There are a lot of analogies used to describe how diversification works in investing. Eggs in baskets is a common one. We're opting for the weekly grocery shop.

Picture this...

At the weekly grocery shop, you’ve selected a punnet of fresh strawberries. You bring it home. Start to unpack. Hungry, you bite into a strawberry and realise it’s sour. Bummer. Fortunately, the rest of the punnet is beautifully sweet, so you don’t feel too bad.

Over the course of multiple supermarket shops, some strawberries will be stale. Sometimes, what appears fresh on the outside, will be rotten on the inside. But for the most part, the strawberries are luscious and one bad one doesn’t ruin the whole punnet.

This is exactly why diversification is important. You’re better off keeping a mixed bag of goods because if you pick the rotten strawberry, there’s bound to be another one in the basket ripe and ready.

Price of admission

Now, let’s link our strawberry analogy with investing.

Diversification lowers risk by spreading your savings across several investments. That way, if one asset performs poorly, you have other investments that help bolster the overall portfolio.

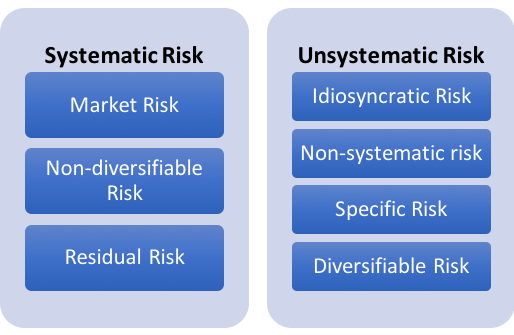

In financial markets, there are two overarching risk categories: systematic risk and unsystematic risk. Systematic risk refers to something that has the potential to impact all types of investments.

These risks are usually macroeconomic in nature and include global conflicts, inflation, natural disasters and interest rates. Regardless of what you’re invested in, it’s difficult to avoid these risks. Subsequently, systematic risk is often referred to as the price of admission.

“Volatility is the price of admission. The prize inside is superior long-term returns. You have to pay the price to get the returns.” – Morgan Housel

Free lunch

Fortunately, there are some risks you can avoid. Unsystematic risks are specific to assets or corners of the market, but they generally won’t impact the entire financial system. Using our grocery example, a new competitor, a regulatory ban on $1 milk or a product recall would all impact the profits of a supermarket but have little impact on other businesses.

The best way to avoid these risks is to diversify. It’s fancy finance lingo for the adage “‘don’t put all your eggs in one basket”. If you invest across a range of different assets and asset classes, you are less likely to be negatively impacted by one egg in your basket underperforming.

It’s also worth noting that only around 4% of companies account for all of the excess returns in the share market. Instead of trying to pick the winners, why not purchase the entire market and guarantee ownership of the best-performing companies?

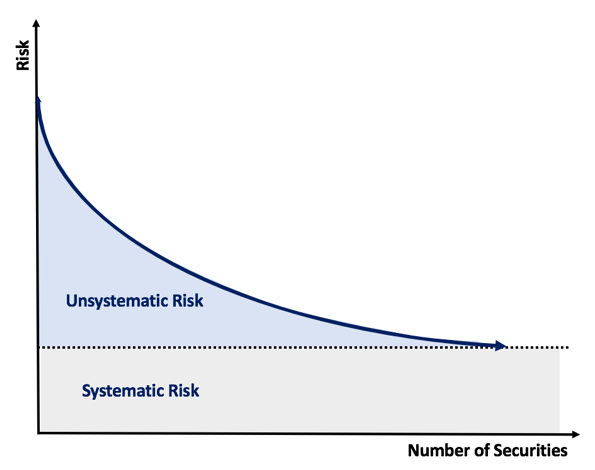

As you can see in the graph below, risk generally decreases as the number of securities in a portfolio increases. Because diversification doesn’t cost anything or require any great skill, Nobel Prize laureate Harry Markowitz coined diversification as the only free lunch in investing.

|

Reducing unsystematic risk

To reduce unsystematic risk, investors want to own assets that have low or negative correlations with one another. That way if one asset decreases in value, the other asset will increase and offset some or all of the decline.

The simplest way to diversify is to own asset classes such as shares, property, bonds and cash. Typically shares/property and bonds/cash have a low correlation to one another, and therefore smooth out portfolio returns.

Investors can also diversify across geographies or sectors. The Australian market is dominated by miners and banks, whereas overseas markets such as the United States have higher allocations to technology companies. This provides more diversification than simply sticking with Australian shares.

Even though diversification is a free lunch, it can be hard to do as an individual investor. Investing overseas or in unfamiliar sectors is daunting and difficult to administer.

Fortunately, there is a solution. Exchange-traded funds (ETFs) provide instant diversification for investors in a low-cost and simple product. The ETF owns a basket of securities that investors can buy and sell without the need for onerous tax forms or overseas brokerage accounts.

Diversification with InvestSMART

The investment team at InvestSMART has handpicked the best ETFs for building long-term wealth and packaged them in simple ready-to-go portfolios. There are several portfolios to choose from depending on your investment goals and risk appetite. Best of all, the portfolios diversify your savings across asset classes and geographies to minimise risk.